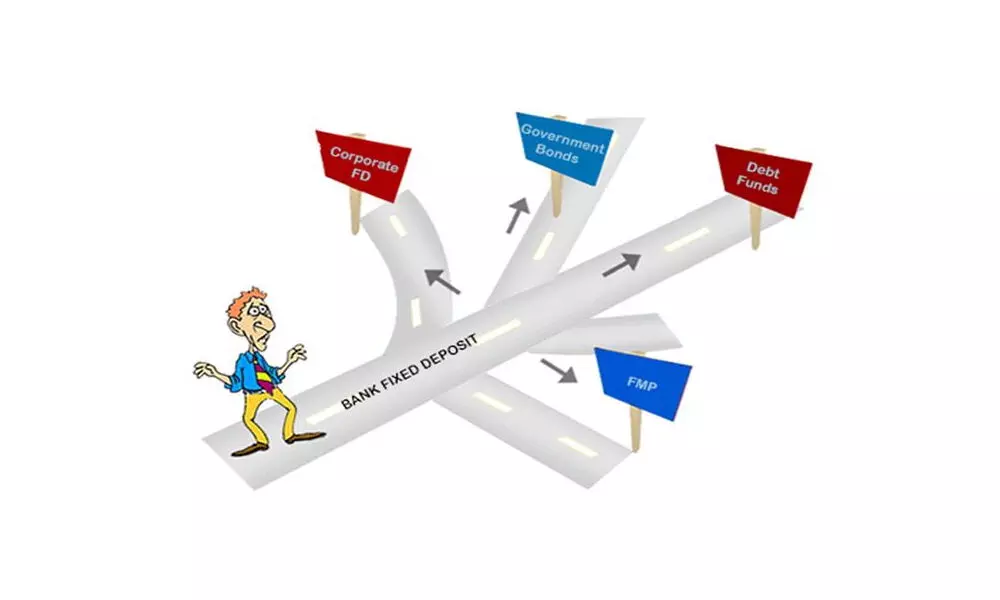

Beware of alternative debt options

image for illustrative purpose

The interest rates have been on a south bound journey for the last couple of years and pandemic only compounded to the bottom. It's not an endemic to India, but most of the world has been on this path for the last two decades. The productivity gains and deflationary pressures have had a tremendous impact on the interest rates across the board, a phenomenon seems to remain, at least looking from the experience of the developed world.

This has put stress on the investors who were looking to eke out income from interest earning assets. The continued falling rates would favour the borrowers, but impact the lenders/savers, who make less returns out of their investments. It has altered the behaviour of some of the conservative investors and has led to overstep on the risk boundaries. Particularly, senior citizens and other conservative investors are forced to seek investment options that have a relatively higher risk profile than they're otherwise comfortable with, for generating an additional return.

The favourite among the conservative investors was and has been bank fixed deposits. This is evident from the enormous chunk of individual savings that these occupy. Of course, they come with a convenience of easy process of deposit/withdrawal, paperwork and trust of the bank with a fair amount of regulation and supervision. Despite the tax inefficiency especially with investors at higher tax slabs and lower real returns (inflation adjusted), they remain popular among most investors.

Possibly, the next best thing comes through the option of debt mutual funds, though, there are multiple variants serving various purposes (depending upon the timelines of the investors). These are tax efficient with a fair ease of investing and redemption, while sporadic events of default (of capital or interest payout) surface, hence requiring guidance in picking the right fund. Unlike the plain vanilla of a bank fixed deposit, these come with numerous flavours and choosing an appropriate fund becomes critical. The underlying asset among all these funds mostly being same, the structure, time horizon and investment mix calls for better understanding of the constituents.

We very well know that India is a capital starved nation, but with a high requirement of capital as the infrastructure is being developed. The government spend increased, but is insufficient relative to the demand, the gap was earlier funded by financial institutions and Non-Banking Financial institutions (NBFCs). The collapse of IL&FS and the amplified scrutiny of Reserve Bank of India (RBI) in identifying the non-performing assets (NPA) has only constrained further infusion of the capital into these sectors. This re-evaluation of exposure to infrastructure projects has aggravated further leading to imbalance in the capital inflows.

Infrastructure Investment Trusts (InvIT) are designed to address this gap by allowing the infra developers to monetize their assets to raise capital. These are trusts, registered with the Securities Exchange Board of India (Sebi), hold the operational infrastructure assets with consistent cashflows, while the investors in these are allocated units through public or private placement. These are an intermediate between debt and equity, assist in deleveraging the balance sheet of the infra companies. The unitholders (investors) earn revenue through annual distribution of dividends and/or interests. Sebi has levied certain guidelines to bring transparency and uniformity in the way InvITs are operated.

Listed InvITs are required to maintain a maximum leverage ratio of 49 per cent and could be increased to 70 per cent subject to a post-listing track record of six continuous distributions to the unitholders. These instruments currently have been concentrated mostly in the space of roads, power and telecom sectors. The regulation demands that the portfolios should contain at least 80 per cent of their investment in operational assets and also ensure a minimum of 90 per cent of the free cashflows are distributed to the investors. These measures help to provide steady returns, higher dividend possibilities and long-term cashflows (due to nature of the project tenures) with moderate capital appreciation. The government's impetus to fund and advance the overall infrastructure of the nation has encouraged such offerings by the issuers and we could witness such issuances to go up in the coming years. The minimum subscription amount for a publicly listed InvIT has been amended by Sebi from Rs 10 lakh to Rs 1 lakh making it suitable for retail participation also. However, these products are not a direct alternative to the debt options. Though all the current listed vehicles bear AAA rating and so solvency risk is limited, the risk of payment (cashflows) is not guaranteed. The other risk is the ability of the sponsor (issuer) to scale up the offering cost effectively and at an economical rate. Then there's always the factor of corporate governance that can't be ruled out altogether other than systemic risks that arise due to regulatory and government policy decisions. To sum up, an investor with a moderate risk appetite and a medium to long-term horizon could take an exposure up to 10 per cent in the portfolio.

(The author is a co-founder of 'Wealocity', a wealth management firm and could be reached at [email protected])